Would you like to learn new strategies for making money in the markets? Marwood Research contains advanced trading strategies specifically designed for stocks and ETFs.

Over 40 trading and investing strategies can be found on our program complete with full rules and source code. This makes it easy for you to get started with our systems.

You will also learn about trading system design, the importance of data, how to stress test trading strategies and tips for improving trading system results.

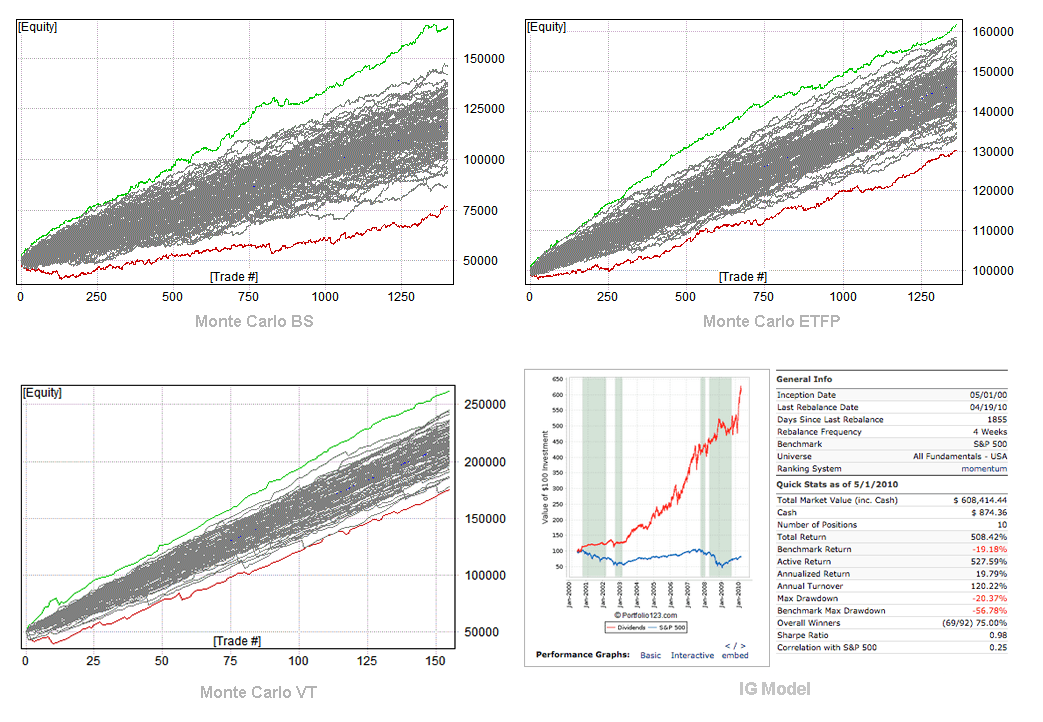

Our courses contain a mixture of trend following and mean reversion strategies. See the sample equity curves further down this page for more details.

All our systems are tested out-of-sample and provided with full rules and simulation results.

We do not believe in complex systems because they are more likely to fail. We discuss the pros and cons of each strategy and place an emphasis on simplicity and robustness.

Use our systems as they are designed or modify them to suit your own unique trading style.

Your confidence will suffer without reliable backtesting results.

That’s why we teach you how to run accurate backtests, mistakes that you need to avoid and the importance of working with the right data.

You will also learn how to automate your trading strategies using Microsoft Excel and the Interactive Brokers API.

Get a fully automated platform in Excel for trading breakouts. Ideal for day trading up to 50 stocks when speed is crucial.

Amibroker is the most powerful, flexible and affordable software for systematic traders. It’s programming language AFL is unique in that it is easy to learn and built specifically for the task of building trading systems.

Amibroker is able to perform complex operations in the box that many institutional level programs are unable to do without custom coding.

In Marwood Research we teach you how to use Amibroker from the ground up and include numerous examples, tutorials, code templates and full strategy codes. Also included, an advanced course on the Amibroker CBT.

On our course Candlestick Analysis for Professional Traders we show you the historical performance of the 25 best candlestick patterns.

We analyse common patterns such as shooting star, bullish engulfing and inverted hammer and we show you which patterns to pay attention to and which to ignore.

Very quickly gauge strength in the market of your choice and get a full trading strategy based on the best patterns we found. If you have ever struggled with candlestick charts this course is for you!

In The Big Volatility Short we teach you a unique volatility system with a truly massive trading edge.

Further, we show you how volatility ETFs work, why they decay so rapidly, and the pros and cons of various trade strategies.

You will also receive live trade alerts (by email) whenever we get a new trade signal.

A membership to Marwood Research also includes access to our Financial Research Spreadsheet containing 400+ academic papers.

Use this spreadsheet to track interesting papers and come up with new trading strategies of your own.

Speed up the process of finding new strategies and keep on top of important topics with this database.

On the course Zero To One Million we show you a unique strategy for investing your monthly income.

The goal is to show that anyone can become a millionaire by investing a small amount into the stock market each month and to prove that there are viable alternatives to index funds.

The strategy is more satisfying than index investing and has the potential for greater long term returns. Yes, you can invest in individual stocks!

Our program contains numerous swing trading strategies ready for you to discover. One such system trades ETFs and is called Trading For Yield.

Trading For Yield made money every year from 2007-2017 with a win rate over 75% and a profit factor over 3 in historical simulations.

Full rules, methods, backtest results and code provided.

All of our Amibroker trading strategies come with downloadable source code that you can use on your own machine. Two strategies are also provided in Quantopian language (python).

You will also receive a handy backtesting template for Amibroker, an automation template for Excel and other downloadable spreadsheets and resources.

If you don’t have Amibroker, don’t worry. All of our trading strategies are explained in detail and are designed to be used without need of any additional software.

A membership to Marwood Research now includes five tutorials to help you trade options including Getting Started With Options plus daily and weekly options income strategies.

Options trading can be complicated and confusing but we break it down so that you can concentrate on what matters – making returns. Our options strategies allow you to generate income with conservative position sizing and lower risk.

No trading education would be complete without a discussion of trader psychology.

On our course Mental Models For Wall Street we show you how to take a more business-like approach to investing with the help of 20 classic mental models.

Models such as the availability bias, misconceptions of chance, the law of small numbers, feedback loops, loss aversion and cognitive dissonance can help you to take control of your emotions and become a more disciplined trader.

There’s more.

As a member of Marwood Research you will also receive bonus lectures and new trading strategies on a regular basis.

We update the program monthly with new ideas, select courses and systems. You will also receive bonus videos and my 2012 eBook How to Beat Wall Street.

Be aware that some of our best performing strategies are recent additions to the program!

- DISCOVER NEW TRADING STRATEGIES

- Find Your Edge

- Learn Backtesting And Automation

- Learn Amibroker

- Conquer Price Action

- Learn Our Favourite Volatility Trade

- Get Our Database Of Financial Research

- Go From Zero To One Million

- Learn To Swing Trade

- Download Code And Resources

- Learn To Trade Options

- Put An End To Emotional Trading

- Receive Bonus Content And Updates

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. NO REPRESENTATION IS BEING MADE THAT THE SYSTEMS WILL PERFORM AS SHOWN. IT SHOULD NOT BE ASSUMED THAT THE METHODS, TECHNIQUES, INDICATORS, ADVICE SHOWN WILL NOT RESULT IN LOSSES. FINANCIAL TRADING WILL ALWAYS BE RISKY AND PROFITS ARE NEVER GUARANTEED. See Full Risk Warning.

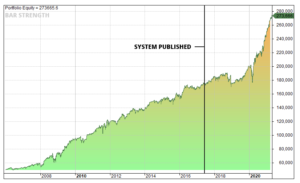

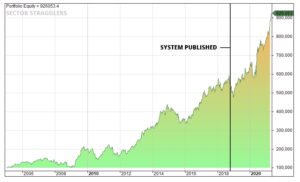

Some of our trading systems have been in operation for some time which means we can also analyse their performance since publication. The following equity curve shows the performance for our Follow The Money system since it was released in 2017.

The next curve shows the performance of our strategy Bar Strength since publication:

The next curve shows the performance of our weekly system Sector Stragglers since publication:

NOTE: EQUITY CURVES SHOW HYPOTHETICAL BACKTEST RETURNS AS PRODUCED IN AMIBROKER AND DO NOT REPRESENT LIVE TRADING RESULTS. SEE FULL RISK WARNING.

Courses Included with Purchase

Original Price: $4525.17 $611

Your Instructor

Joe Marwood & Peter Titus

Joe Marwood is an independent trader and investor specialising in financial market analysis and trading systems. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. He has been in the market since 2008 and working with Amibroker since 2011.

Peter Titus graduated from the University of Wisconsin- Madison with an engineering degree in 2003. He has been actively trading stocks and options since 2006 and has been building automated trading systems in Excel using Visual Basic for Applications (VBA) since 2009. He specializes in day trading stocks and ETFs.

Data Driven Research.

Frequently Asked Questions

Our research is primarily focussed on US equities and ETFs. This is because we feel that the best opportunities are to be found in this area. We believe that beginner traders can save themselves a lot of money by avoiding the forex markets at first since these markets are highly efficient. Having said that, there is plenty of information that will be of use to forex traders, especially in Candlestick Analysis and Mental Models. There will also be future content that focuses on forex topics.

We prefer to focus on US stocks because they are more liquid and we have considerable experience trading these markets. Historical data for US companies is also cleaner and goes back further so it’s more useful for analysis. However, we believe that our research can be well applied to other developed stock markets and we have had some success doing so.

Absolutely. Although most of our research is based on end-of-day historical data it is possible to implement our strategies on shorter timeframes than presented. Trade systems can be setup so as to provide valuable watchlists and next day signals for day traders. There are also a handful of intraday strategies on the program and full code is provided.

The strategies in Hedge Fund Trading Systems have been through out-of-sample testing for validation purposes and the code in Part One has been double checked for mistakes by an independent expert with 12 years Amibroker experience. This verification process includes checking for future leaks and execution errors. We have taken steps to avoid survivorship-bias in our results and we typically incorporate trading costs of $0.01 per share to account for commissions and slippage. However, we cannot guarantee that the strategies are completely error free or that they will perform exactly as shown in a backtest. The same goes for any other trading strategy or idea in the program. Please make sure you have read and understood the Terms of Use and Risk Warning before purchase.

The data we use (Norgate Data) includes delisted securities, historical constituents and is adjusted for capital events and cash dividends. This greatly reduces the chance of survivorship-bias in the results. You can read more about the data we use on the Norgate Data website.

No, the strategies are designed in such a way that most of them can be run with free scanning tools. The rules are explained in detail so you can be sure to execute them correctly. The program also contains many trading strategies that were not developed in Amibroker. The Marwood Value Model, for example, was developed in Portfolio123 and Ranger 1.0 is built in Excel. However, we do recommend Amibroker as a software tool and having a subscription or free trial would be beneficial to the program.

There are a mix of trading systems. The shortest is a day trading strategy for stocks and the longest trades on monthly timeframes. Most of the Amibroker systems trade stocks belonging to the S&P 1500 or Russell 3000 universe. Peter’s volatility course trades volatility ETF’s and utilises options contracts. The Marwood Value Model was designed in Portfolio123 and uses their own All Fundamentals database. Please see the individual course outlines for more details.

Hedge Fund Trading Systems contains proprietary trading system formulas that we do not want shared around as doing so could greatly reduce their profitability. By purchasing the program you solely agree not to distribute or share any of the formulas found inside. Please make sure you read the full terms of use and risk warning before signing up. We feel our combined course bundle offers tremendous value, but if you aren’t satisfied, contact us within 48 hours and a full refund will be provided.

After enrolling, you will have unlimited access to the program including updates and new content for the duration of your membership – across any and all devices you own. Subscription memberships renew at your original purchase price and can be cancelled at any time.

Absolutely. We have several courses dedicated to Amibroker including Essentials For Amibroker, Mastering Amibroker AFL, Amibroker CBT Intensive and Build a Professional Trading System. The course Hedge Fund Trading Systems also contains a detailed back-test template and you will pick up plenty of Amibroker tips and techniques, particularly related to the back-testing of trading systems.

Yes. As a member of Access All Areas you can expect regular updates and new content. That might be a new course, a full trading strategy or useful article. We are constantly working to find new trading ideas and improve the quality of the program. On occasion, we may also introduce you to new materials that are not part of Access All Areas.

When you enrol in Access All Areas you gain access to all of our existing trading strategies and courses. You’ll discover complete trading systems with code, a quantitative value investing model, a trend following course, a course on volatility, candlestick analysis, a course on trading psychology (mental models) and lots more besides. The program includes instructor support and will also be kept up to date with new material. On occasion, we may also introduce you to new materials that are not part of Access All Areas.

All of our Hedge Fund Trading systems have been back-tested using data from Norgate Data. Subscription to Norgate for US stock data is beneficial but not required as we do go through the rules in detail and provide code for non-Norgate users.

No trading strategy is guaranteed to make money as the future is never known. Anyone who claims otherwise is withholding the truth so the systems are best thought of as useful ideas for further research. They can be adapted and modified as you wish.

Simple. Robust. Practical.

- One year access to all existing courses and trading strategies

- More than 40 trading and investing strategies included

- Amibroker source code and templates

- Educational videos & email support

- Monthly updates and new strategies – free for one year

- Payment recurs yearly. Cancel anytime.

This is a subscription product billed on a yearly basis until you cancel. Cancel anytime from the account management page. Contact Stocksoft Research at Marwood Research for more info.

- Lifetime access to all existing courses and trading strategies

- More than 40 trading and investing strategies included

- Amibroker source code and templates

- Educational videos & email support

- Monthly updates, new strategies & select new courses (free)

Marwood Research Organization is designed to give organization members shared access to our content. The program is perfect for small independent businesses, boutique research firms and start-up hedge funds.

What you get

- Everything as included in Access All Areas

Plus:

- 10 unique licences for your organisation members

- Lifetime Access

Before making payment, please read the Terms of Use and Risk Warning. Making a payment assumes you have agreed to the policies inside.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL, OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED WITHIN THIS SITE, SUPPORT AND TEXTS. OUR COURSE(S), PRODUCTS AND SERVICES SHOULD BE USED AS LEARNING AIDS ONLY AND SHOULD NOT BE USED TO INVEST REAL MONEY. IF YOU DECIDE TO INVEST REAL MONEY, ALL TRADING DECISIONS SHOULD BE YOUR OWN. Financial trading is risky and you can lose money. JB Marwood and Marwood Research is not a registered investment advisor and nothing on this site is to be regarded as personalised investment advice.See full Risk Warning.